💼Start Your High-Earning Career as a Life Planner with a TATA AIA!

🌟Looking for extra income or a flexible career? Build a profitable future!

Who's this For?

Job Seekers: Want a career with high earning potential.

Career Switchers: Looking for flexible and rewarding work.

Ambitious Professionals: Ready to help others secure their future.

Retired Persons: Seeking new ways to stay active and generate income after retirement.

Women/Home Makers—turn your skills into income with a fulfilling Life Planner role!

Ex-Bankers: Experienced banking

professionals seeking alternative career paths.

VRS Executives: Exploring new opportunities after opting for Voluntary Retirement Schemes.

Self-employed Persons: Interested in diversifying income streams and exploring investment opportunities.

Highly Educated Home Makers: Ready to re-enter the workforce or pursue entrepreneurial ventures after a career break.

This is for you...

📅 Don’t wait – limited seats available.

👇 Click the button below to reserve your spot!

Ready to Unleash Your Inner Entrepreneur?

Learn How to Break Free from Financial Limitations and Forge Your Path to Success in the Investment World!

Who's this For?

Retired Persons: Seeking new ways to stay active and generate income after retirement.

Ex-Bankers: Experienced banking professionals seeking alternative career paths.

VRS Executives: Exploring new opportunities after opting for Voluntary Retirement Schemes.

Self-employed Persons: Interested in diversifying income streams and exploring investment opportunities.

Highly Educated Home Makers: Ready to re-enter the workforce or pursue entrepreneurial ventures after a career break.

This is for you...

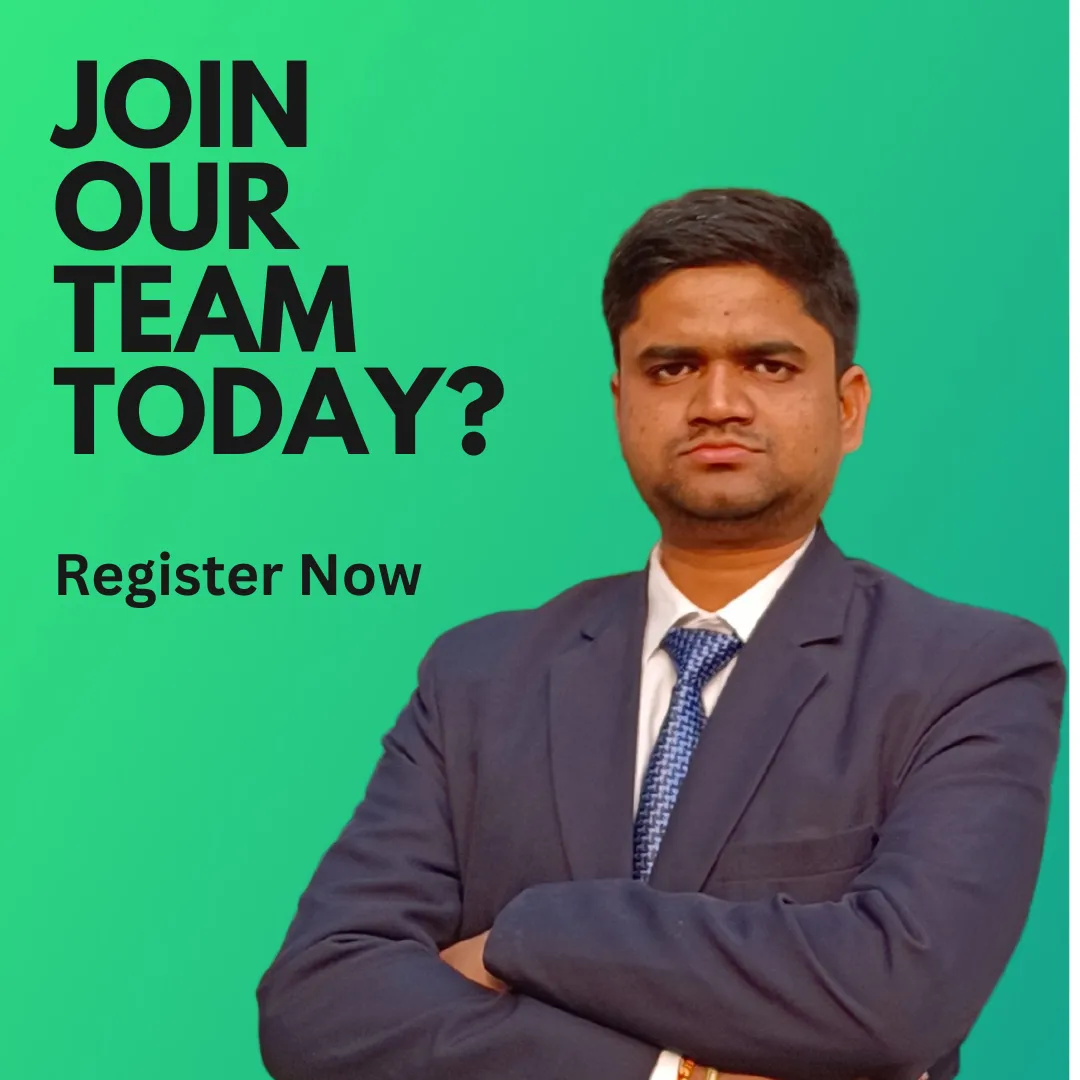

Instructor

Anand Mohan

Founder & Managing Partner

NO COMPLEX TERMINOLOGY, JUST VALUE!

This is an instructional and experiential workshop wherein you will actually learn 10 techniques and experience shifts in the masterclass itself.

Date

06-DEC-2025

Time

11:30 AM

Language

English

Duration

90 Mins

Date: 03-DEC-2025

Time: 11:30 AM

Language

English

Duration

90 Mins

In This Training, You'll Discover...

Secret # 1

The simple 3-step formula to successfully close financial planning deals.

Secret # 2

Proven strategies to find and retain high-value clients.

Secret # 3

How to achieve work-life balance while earning big.

Why Attend This Masterclass

Learn from Experts: Attend to gain insights from seasoned professionals in the investment industry.

Gain Financial Confidence: Empower yourself with essential skills and knowledge to take control of your financial future.

Personalized Guidance: Receive customized investment strategies tailored to your customers goals and risk tolerance.

Network and Connect: Engage with peers and industry professionals to build valuable relationships and explore new opportunities.

Access Exclusive Resources: Receive access to tools and materials to support your ongoing learning and investment journey.

Unlock industry secrets to becoming a top-earning insurance agent.🔑

Gain clarity on the best ways to market and sell Life Planning🔑

Learn strategies to build a steady stream of clients.🔑

Start your journey towards financial independence and growth.🔑

Don't worry, we can help!

Join us as a Life Planner and unlock incredible

opportunities

Clear Investment Strategies : Understand different investment strategies and how to choose the ones that align with their financial goals and risk tolerance.

Financial Planning Skills: Learn how to create a comprehensive financial plan tailored to their individual needs, including budgeting, saving, and investing.

Risk Management Techniques: Acquire knowledge on managing investment risks effectively, including diversification, asset allocation, and risk assessment.

Market Insights: Gain insights into market trends, economic indicators, and investment opportunities to make informed decisions.

Confidence in Decision-Making: Develop confidence in their ability to make sound financial decisions and navigate the complexities of the investment landscape.

Step into a career that offers growth, financial success, and unparalleled supportof the investment landscape.

Learning 1

✨ Effective sales techniques to grow your business.

Learning 2

✨ How to create a consistent stream of income.

Learning 3

✨ How to market insurance products like a pro.

Learning 4

✨ Ways to build long-term relationships with clients.

About Your Coach Anand Mohan

Anand Mohan

Expert in Financial Consultant

Anand Mohan with Over 21+ Years experience, is a trusted financial advisor specializing in Life Planning and Term insurance. He has been providing expert guidance in financial success.

✔️ Helped over 1,000 agents build thriving careers.

✔️ Have a Team of 150 Insurance Business Partners

✔️ Recognized as a top industry leader and trainer.

🎯 Mission: To empower individuals to achieve financial freedom while helping others.

How Anand Mohan has helped 1000+ clients shape their lives

Ready to change your life? Take action and sign up for a class!

What People Say about Anand Mohan

Rohan Sharma - Entrepreneur

🗣️ “The best decision I ever made! My income tripled in 6 months. Anand's insights transformed my approach to investments. His strategies are practical and easy to implement.”

Priya Nair - Marketing Professional

🗣️ “This program gave me the confidence and skills to succeed. This program not only boosted my income but also gave me the confidence to pursue my dreams. Highly recommended!”

Amit Patel - Small Business Owner

🗣️ “The training was practical, insightful, and easy to apply. I never thought I could balance a demanding career and financial planning, but Anand's guidance made it possible.”

Sneha Rao - Freelance Designer

🗣️ “I’m now living the flexible, financially secure life I dreamed of! . Anand techniques I learned have been invaluable in building a steady stream of income while maintaining work-life balance.”

Frequently Asked Questions

Do I need prior sales experience to become an Life Planner?

Not at all! We’ll teach you everything you need to know.

What types of insurance products will I be selling?

The types of insurance products you will sell may vary depending on the insurance agency and your specific role. Common types of insurance products include Life insurance, Term insurance, Retirement Solutions & Child Life Plan. Some agencies specialize in specific niches, such as retirement planning or employee benefits, so it's essential to inquire about the product offerings during the recruitment process.

How do I earn commissions as an Life Planner?

Insurance agents typically earn commissions based on the policies they sell. Commissions are usually calculated as a percentage of the policy premium, and agents may also receive bonuses or incentives for meeting sales targets. It's important to understand the commission structure offered by the insurance agency and how it aligns with your income goals. Onthe total income you can get upto 50% on business done.

Is there room for career growth and advancement in the insurance industry?

Yes, the insurance industry offers ample opportunities for career growth and advancement. As you gain experience and build a client base, you may have the opportunity to take on leadership roles. Continuing education and professional development are also essential for advancing your career and staying competitive in the industry.

Is the webinar really free?

Yes, this webinar is 100% free with no hidden fees.

How long is the webinar?

It’s a value-packed session of just 60-90 minutes.

What happens after the webinar?

You’ll have the opportunity to join our exclusive Life Planner's program.

© 2026 MONEY MATTERZZ - All Rights Reserved. Privacy Policy